What FDA Import Alerts Really Do

The U.S. Food and Drug Administration doesn’t wait for a single bad shipment to hit U.S. shores before acting. If a manufacturer has a history of violating quality standards-like skipping stability tests, falsifying lab results, or using unapproved raw materials-the FDA can slap them with an Import Alert. This isn’t a warning. It’s a red flag that triggers automatic detention of every future shipment from that facility, no inspection needed. Since 1995, this system has blocked over 12 million drug entries annually, stopping unsafe medications before they reach pharmacies or patients.

Here’s how it works: When the FDA finds repeated violations at a foreign manufacturing site, they add that facility to an Import Alert. Once listed, Customs and Border Protection (CBP) holds every incoming shipment from that manufacturer. The drug doesn’t get a second chance. It’s stuck at the port until the company proves it’s fixed the problem. And the proof isn’t just paperwork-it’s audits, testing, and live inspections.

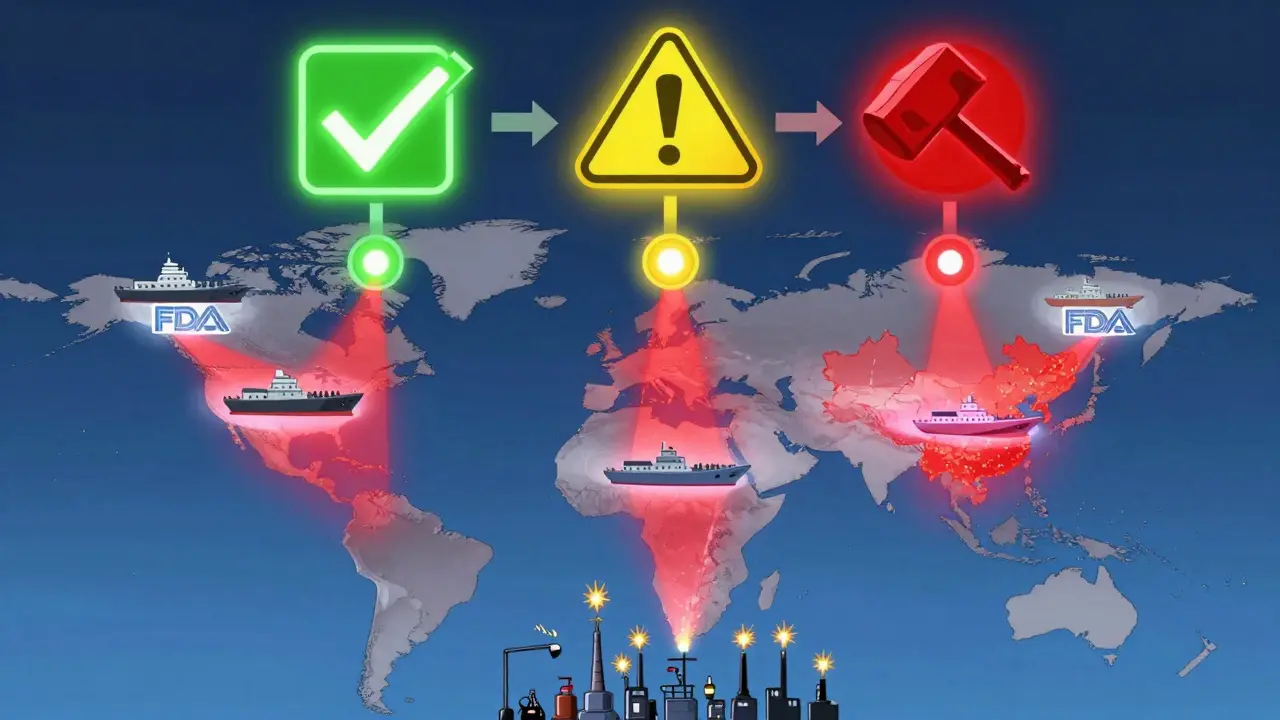

The Green List, Yellow List, Red List System

The FDA doesn’t just say ‘yes’ or ‘no.’ They use a color-coded system to show where a manufacturer stands:

- Green List: Facilities with proven, ongoing compliance. Their shipments clear automatically. Only about 10% of GLP-1 API manufacturers made it here by October 2025.

- Yellow List: Facilities with past violations but showing progress. Shipments are held for review. They can still get cleared if they submit the right docs.

- Red List: Repeated violators. Every shipment is detained without exception. No exceptions. No delays. Just refusal.

This system is designed to reward improvement. A company on the Yellow List can move to Green if they fix their issues and pass three consecutive clean shipments. But falling back into violation? That’s an instant return to Red.

As of November 2025, there were 238 active Import Alerts across all drug types. But the biggest shift came in September 2025, when the FDA launched Import Alert 66-80 targeting GLP-1 active ingredients-semaglutide, tirzepatide, liraglutide, and others. This wasn’t just another alert. It was a full-scale crackdown on the booming weight-loss drug market.

Why GLP-1 Drugs Became the Target

GLP-1 receptor agonists like Ozempic and Mounjaro exploded in popularity after 2022. Demand outpaced supply. That gap created a black market. Counterfeiters started selling unapproved, untested versions of these drugs-often made in facilities with no FDA oversight. Some batches had wrong dosages. Others contained toxic impurities. One lab found 68% of refused GLP-1 shipments had contaminants above safety limits set by the International Council for Harmonisation (ICH Q3D).

The FDA’s September 2025 announcement was blunt: ‘The proliferation of unapproved GLP-1 products poses significant public health risks.’ They didn’t just want to stop bad drugs. They wanted to shut down the entire shadow supply chain. That’s why they created the Green List-to give compliant manufacturers a fast lane while blocking everyone else.

By October 2025, 98.7% of GLP-1 API shipments from non-Green List manufacturers were refused. That’s not a mistake. That’s the system working exactly as designed.

What Happens When a Shipment Gets Refused

If your shipment gets held under an Import Alert, you don’t get a call. You don’t get a letter. You just see it stuck in the CBP system. To get it released, you need to submit:

- A full Certificate of Analysis (CoA) from an FDA-recognized lab

- Third-party audit reports proving your facility meets GMP standards

- Complete traceability of every raw material, down to Tier 3 suppliers

- Proof of root cause analysis and corrective actions taken

Many companies fail because they think ISO 9001 certification is enough. It’s not. The FDA requires audits from agencies they specifically approve. One manufacturer lost $1.2 million in 72 hours because their auditor wasn’t on the FDA’s list-even though they had perfect quality records.

If you can’t fix the problem within 90 days, the FDA and CBP force you to destroy or export the shipment. And if you try to sneak it out under false paperwork? You could face liquidated damages up to three times the value of the goods. For a $900,000 shipment, that’s over $2.7 million in penalties.

Who’s Getting Hit the Hardest

India is the epicenter of the crackdown. Of the 89 manufacturers affected by the GLP-1 Import Alert, 73 (82%) are based in India. China has 9, Europe has 7. Why? Because Indian facilities have historically been the biggest suppliers of generic APIs to the U.S. But many never upgraded their quality systems to meet modern FDA standards.

Some Indian companies are scrambling. One major generic manufacturer, Viatris, reported a $417 million revenue drop in Q3 2025 because they couldn’t get their APIs cleared. Meanwhile, Novo Nordisk’s approved suppliers gained 18.7% market share in just six weeks.

The fallout is real. The Indian Pharmaceutical Alliance estimates 28,500 jobs are at risk. Pharmacies in the U.S. are seeing 14.3% price hikes on compounded GLP-1 versions because the legal supply can’t keep up.

How Companies Are Fighting Back

Some manufacturers are trying to game the system. ProPublica found 157 products received enforcement exemptions since 2013-even when they had ongoing violations. Mylan/Viatris’ endoscopy equipment got exempted 14 times. Shilpa Medicare’s diabetes meds got exempted seven times in 2024 alone.

Others are paying brokers to falsify export documents so they can avoid destruction fees. The FDA issued Warning Letter 541598 in October 2025 to a Singaporean intermediary caught doing exactly that.

But the smartest companies are investing-hard. Pfizer spent $500,000 per supplier to install blockchain traceability using the MediLedger network. They now have 99.8% Green List clearance. Other firms are spending $200,000-$500,000 on real-time batch tracking systems to prove every step of production.

What It Takes to Get Off the Alert List

Getting removed from an Import Alert isn’t easy. The FDA requires four steps:

- A full facility inspection (minimum 5 days)

- A documented root cause analysis with a corrective action plan (CAPA)

- Three consecutive shipments that pass inspection

- Executive certification signed by the company’s top quality officer

Most companies fail on the first try. FDA data shows it takes 2.3 additional submissions on average. The ones that succeed? They include video proof of their fixes-like showing the new lab equipment in action or walking auditors through their updated training program. Companies that include video have an 87.4% approval rate. Those that just send documents? Only 42.1%.

And the timeline? It takes 11.7 months on average to get off an Import Alert. That’s over a year of lost sales, lost customers, and lost trust. Health Canada does it in 6.3 months. The FDA doesn’t move fast.

The Bigger Picture: What’s Next

The GLP-1 Import Alert is just the start. In November 2025, FDA Commissioner Dr. Robert Califf announced the same framework will expand to all high-risk biologics-starting with monoclonal antibodies in Q1 2026. That means cancer drugs, autoimmune treatments, and other complex biologics will soon face the same level of scrutiny.

China’s NMPA announced on January 1, 2026, that all API exporters to the U.S. must now meet FDA-equivalent certification standards. The European Commission is following suit, planning to adopt similar API screening by mid-2026.

Industry analysts predict 65-75% of global API manufacturers will need to spend $500,000 to $2 million to upgrade their systems by 2027 just to keep selling to the U.S. market. That’s not just a compliance cost. It’s a market reset.

The FDA isn’t trying to punish foreign manufacturers. They’re trying to protect patients. But the system is blunt. It’s fast. And it’s leaving no room for error. If you’re a manufacturer, your quality system isn’t optional anymore. It’s your only path to the U.S. market.

Katelyn Slack

January 6, 2026 AT 05:34Saylor Frye

January 6, 2026 AT 16:53Gabrielle Panchev

January 8, 2026 AT 01:33Katie Schoen

January 9, 2026 AT 05:44Harshit Kansal

January 9, 2026 AT 18:08Stuart Shield

January 10, 2026 AT 01:02Tiffany Adjei - Opong

January 10, 2026 AT 02:27Mukesh Pareek

January 11, 2026 AT 21:09Ashley S

January 13, 2026 AT 03:58Susan Arlene

January 13, 2026 AT 20:53Indra Triawan

January 15, 2026 AT 13:59Melanie Clark

January 15, 2026 AT 14:23Lily Lilyy

January 16, 2026 AT 15:30