Ever filled a prescription for a generic drug and been shocked by the price-even though you have insurance? You’re not alone. In 2024, 42% of insured adults in the U.S. paid more out-of-pocket for a generic medication than they would have if they’d paid cash at the pharmacy. This isn’t a glitch. It’s how the system was designed.

Who’s Really Setting the Price?

You might think your insurer or pharmacy sets the price for your generic pills. But the real power lies with Pharmacy Benefit Managers, or PBMs. These are the hidden middlemen between drug manufacturers, insurers, and pharmacies. Three companies-OptumRx, CVS Caremark, and Express Scripts-control about 80% of the PBM market. They decide which generics are covered, how much pharmacies get paid, and what you pay at the counter. PBMs don’t just negotiate prices. They build lists called Maximum Allowable Cost (MAC) lists. These lists set the maximum amount a pharmacy can be reimbursed for a generic drug. But here’s the catch: the MAC price is often lower than what the pharmacy actually paid to buy the drug from the wholesaler. That gap? That’s where the system starts to break.The Hidden Profit: Spread Pricing

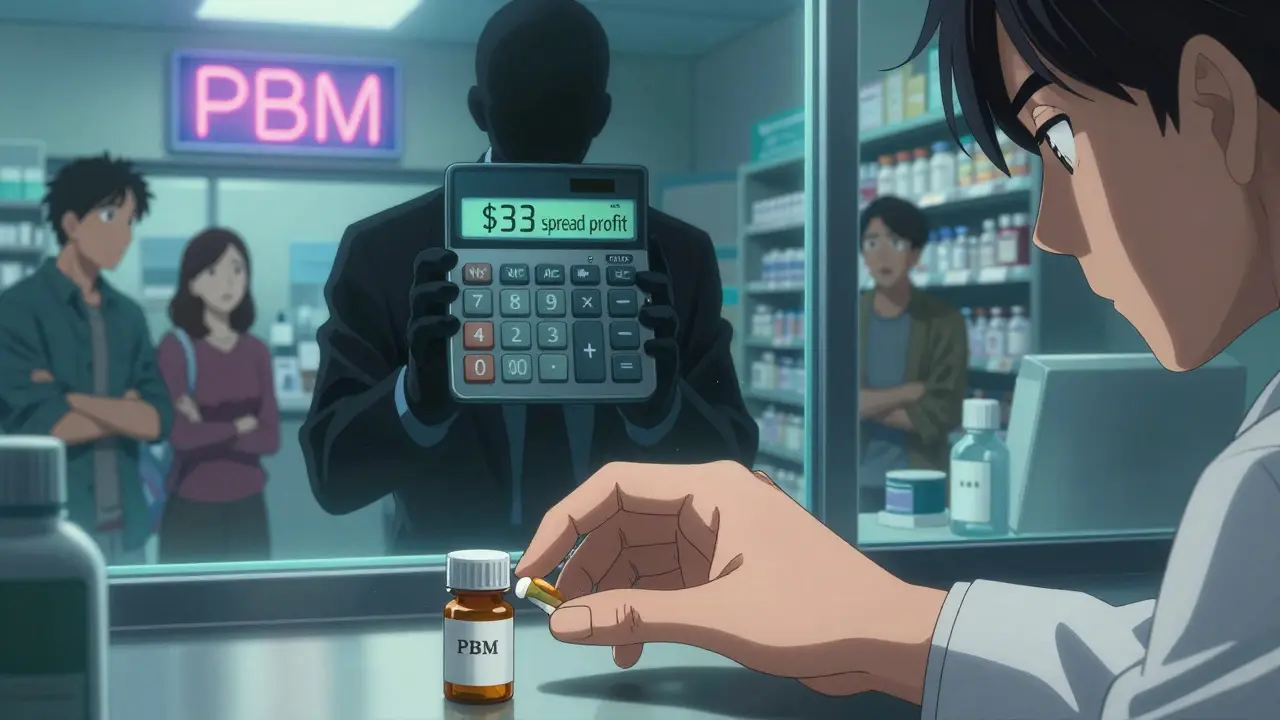

Spread pricing is the engine behind most of the confusion and frustration. Here’s how it works: your insurer agrees to pay the PBM $45 for a generic blood pressure pill. The PBM then tells the pharmacy it will reimburse them $12 for that same pill. The $33 difference? That’s the PBM’s profit. And you, the patient, never see it. This isn’t rare. A 2024 report from Evaluate Pharma estimated that spread pricing generates $15.2 billion annually in undisclosed revenue-68% of it from generic drugs. PBMs don’t have to tell you this is happening. In fact, 92% of PBM contracts include gag clauses that legally prevent pharmacists from telling you that paying cash could save you money.Why Does This Happen?

The system was built on a promise: volume buys savings. PBMs claim they use their massive buying power to negotiate lower prices from drug makers. And they do. But here’s the twist: the higher the list price of a drug, the bigger the rebate the PBM gets from the manufacturer. So there’s an incentive to push drugs with high list prices-even if the actual cost to produce them is low. For generics, which cost pennies to make, this creates a bizarre outcome. A drug that costs $0.10 to manufacture might have a list price of $10. The PBM negotiates a $7 rebate. They then set the MAC reimbursement at $4. You pay a $5 copay. The pharmacy loses money. The PBM pockets $6. And you’re told you’re getting a “discounted” price.

What It Costs Pharmacists

Independent pharmacies are on the front lines-and they’re losing. To even participate in PBM networks, pharmacies must invest in expensive billing software that costs around $12,500 to set up. Then they spend 200 to 300 hours a year trying to decode changing reimbursement rules. Worse, PBMs often do “clawbacks.” After paying a pharmacy $12 for a prescription, they later demand $3 back because the MAC rate was lowered retroactively. In 2023, 63% of independent pharmacies reported being hit by clawbacks. Between 2018 and 2023, 11,300 independent pharmacies closed because they couldn’t survive these conditions.Patients Pay More Than Cash

The most jarring part? Insured patients often pay more than people who pay cash. A 2023 Wall Street Journal investigation found patients on PBM networks paying $45 for a generic cancer drug while cash buyers paid just $4. Reddit threads are full of similar stories: “I paid $45 with insurance. The cash price was $4. The pharmacist told me not to say anything.” A 2024 Consumer Reports survey of 2,300 insured adults found that 28% had this happen multiple times a year. For people on fixed incomes, this isn’t a minor inconvenience-it’s a health risk. Many skip doses or split pills because they can’t afford what their insurance says they should pay.Why Formularies Don’t Mean Savings

Insurers use formularies to control costs by favoring certain drugs. But formularies aren’t about what’s cheapest-they’re about what the PBM gets the biggest rebate on. A generic drug might be clinically identical to another, but if one has a bigger rebate, that’s the one that gets listed as “preferred.” That’s why you might be told your medication isn’t covered-or you need prior authorization-even though it’s a generic. The drug you need isn’t on the PBM’s preferred list. So you’re stuck paying more, switching drugs, or fighting through paperwork.What’s Changing?

Pressure is building. In September 2024, the Biden administration issued an executive order banning spread pricing in federal programs, effective January 2026. Forty-two states are now passing laws requiring PBMs to disclose their pricing practices. The 2025 Medicare Drug Price Negotiation Program will expand to 20 drugs, and lawmakers are pushing bills like the Pharmacy Benefit Manager Transparency Act of 2025, which would force PBMs to pass 100% of rebates to insurers. Some insurers are starting to bypass PBMs altogether. A few large employers now use direct contracting models, paying pharmacies a fixed fee and cutting out the middleman. In those cases, patients pay less, pharmacies make more, and transparency improves. But these are rare-only 12% of employer plans use them.What You Can Do Right Now

You don’t have to wait for policy changes to protect yourself:- Always ask the pharmacist: “What’s the cash price?”

- Use apps like GoodRx or SingleCare to compare prices before you fill your prescription.

- If your copay is higher than the cash price, ask your insurer to reprocess the claim as a cash payment.

- Report surprise bills to your state’s insurance commissioner. These complaints are starting to drive change.

The Bigger Picture

The U.S. spends $620 billion on prescription drugs every year. Generics make up 90% of prescriptions but only 23% of total spending. That’s because the system isn’t designed to lower costs-it’s designed to shift them. PBMs profit from complexity. Pharmacies are squeezed. Patients are confused. And the people who designed the system? They’re still making money. The real question isn’t whether generic drugs should be cheap. Of course they should. The question is: why does it take so much effort to get them that way?Why do I pay more for a generic drug with insurance than without?

Your insurance uses a Pharmacy Benefit Manager (PBM) to process claims. The PBM charges your insurer one price, pays the pharmacy a lower price, and keeps the difference-called spread pricing. Even though you pay a copay, you’re still paying the higher price set by the PBM. Meanwhile, the cash price reflects what the pharmacy actually paid for the drug, which is often far lower.

What is a MAC list and how does it affect my drug cost?

A Maximum Allowable Cost (MAC) list is a pricing schedule created by PBMs that sets the highest amount they’ll reimburse a pharmacy for a generic drug. If the pharmacy’s cost to buy the drug is higher than the MAC, the pharmacy loses money. This forces pharmacies to accept lower payments or stop carrying certain generics, limiting your choices and sometimes increasing your out-of-pocket cost.

Can my pharmacist tell me if cash is cheaper than my insurance copay?

Legally, they often can’t. Most PBM contracts include gag clauses that prevent pharmacists from informing patients about lower cash prices. But these clauses are being challenged in court and banned in many states. If your pharmacist seems hesitant, ask directly: “What’s the cash price?” They’re allowed to answer that.

Are generic drugs really the same as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredient, strength, dosage form, and route of administration as the brand-name version. They must also meet the same quality and safety standards. The only differences are in inactive ingredients (like fillers) and packaging. For 90% of people, generics work exactly the same.

Why do PBMs have so much control over drug pricing?

PBMs control the flow of prescriptions through their networks. Insurers rely on them to manage drug benefits, and pharmacies need access to those networks to get paid. With three companies handling 80% of the market, they have enormous leverage. Manufacturers depend on PBMs to get their drugs on formularies, and patients have little say in which PBM their insurer chooses. This consolidation gives PBMs outsized power to set terms.

Raushan Richardson

December 27, 2025 AT 04:21I used to pay $40 for my generic blood pressure med with insurance. One day I asked the pharmacist for the cash price-$5. I almost cried. I’ve been paying cash ever since. My insurer still thinks I’m on their plan, but I’m just saving my life, one $5 pill at a time.

John Barron

December 28, 2025 AT 23:01It is imperative to elucidate that the structural inefficiencies inherent within the Pharmacy Benefit Manager (PBM) ecosystem are not merely a function of market failure, but rather a deliberate, rent-seeking architecture engineered to externalize costs onto vulnerable patient populations. The aggregation of market power among three oligopolistic entities constitutes a classic case of monopolistic exploitation, wherein the principal-agent problem is exacerbated by the absence of transparency and the institutionalization of gag clauses-violations of fiduciary duty under the guise of contractual law.

Moreover, the perverse incentive structure wherein rebates are contingent upon inflated list prices-rather than actual manufacturing cost-represents a grotesque distortion of economic rationality, wherein the value chain is inverted: the cheapest drugs are penalized, and the most expensive are rewarded. This is not capitalism-it is feudalism with a pharmacy receipt.

Liz MENDOZA

December 30, 2025 AT 02:09My grandma used to split her pills because her copay was $35 and the cash price was $6. She didn’t tell anyone because she was ashamed. I didn’t find out until she was in the hospital. We switched to cash. She’s been fine for two years now. If you’re reading this and you’re paying more than cash-just ask. Don’t be embarrassed. It’s not your fault. The system is rigged. And you’re not alone.

Will Neitzer

December 30, 2025 AT 03:02The systemic manipulation of generic drug pricing by PBMs represents a profound breach of fiduciary responsibility by entities entrusted with cost-containment mechanisms. The utilization of Maximum Allowable Cost (MAC) lists, coupled with retroactive clawbacks and contractual gag clauses, constitutes a multi-layered regulatory arbitrage that undermines both consumer autonomy and provider viability. The economic model employed is not sustainable, nor is it ethical.

It is worth noting that the 80% market concentration among OptumRx, CVS Caremark, and Express Scripts creates a de facto cartel, which, under U.S. antitrust jurisprudence, should trigger immediate Department of Justice scrutiny. The fact that this has not occurred is a testament to the lobbying power of the PBM-industrial complex, which has successfully framed its extractive practices as ‘efficiency.’

Furthermore, the Biden administration’s executive order banning spread pricing in federal programs is a necessary, albeit insufficient, corrective. To achieve true reform, Congress must pass the Pharmacy Benefit Manager Transparency Act of 2025 in its original, unamended form-and eliminate all PBM ownership of retail pharmacies to sever the conflict of interest.

Janice Holmes

December 30, 2025 AT 15:14THEY’RE LYING TO YOU. EVERY SINGLE DAY. YOU THINK YOU’RE SAVING MONEY WITH INSURANCE? NO. YOU’RE BEING ROBBED. PBMs are the VAMPIRES of healthcare. They don’t make anything. They don’t deliver anything. They just suck the blood out of pharmacies and patients while wearing a white coat and saying ‘we’re lowering costs.’

And the worst part? The pharmacists KNOW. They see you crying at the counter. They want to help. But if they say a word, they lose their license. They’re trapped. Just like you.

GoodRx isn’t a hack. It’s a rebellion. And if you’re not using it? You’re complicit.

Olivia Goolsby

December 31, 2025 AT 14:13This is all part of the Great Pharma-Insurance-PBM Cabal, folks. You think this is about drugs? No. It’s about control. The same people who run your insurance also own the PBMs, who own the pharmacies, who own the labs, who own the data that tracks your health-and they’re using it to make sure you stay sick. Why? Because sick people spend more. And more spending = more profit. They don’t want you healthy. They want you addicted to $45 pills so they can keep taking $33 from every transaction. It’s not capitalism-it’s medical slavery. And they’ve been doing this since the 90s. The government’s been in on it. The FDA? Complicit. The AMA? Silent. Even your doctor doesn’t know how deep this goes. You’re not just being overcharged-you’re being watched. And they’re laughing.

Alex Lopez

January 1, 2026 AT 22:30So let me get this straight: we’ve created a system where the cheapest drugs are the most expensive for patients, and the only people who benefit are the ones who don’t even touch the medicine? Brilliant. Just brilliant. I mean, who thought of this? A committee of Wall Street executives who also run a D&D campaign? ‘Let’s make a game where the players pay the most for the least valuable item, and we hide the rules behind a legal contract written in Latin.’

Also, ‘gag clauses’? That’s not a business model. That’s a plot twist in a dystopian novel. And yet, here we are.

Monika Naumann

January 3, 2026 AT 00:23It is lamentable that the United States, a nation founded on principles of liberty and justice, has permitted its healthcare system to be hijacked by corporate oligarchs who exploit the vulnerable for profit. This is not a market failure-it is a moral collapse. The Indian healthcare model, wherein generic drugs are produced at scale and distributed at near-zero cost through public pharmacies, demonstrates that affordability and quality are not mutually exclusive. Why does America, the richest nation on Earth, choose greed over compassion? The answer lies not in economics-but in character.

Elizabeth Ganak

January 4, 2026 AT 02:43lol i just use goodrx now. i used to be mad but now i just laugh. my insulin was $450 with insurance, $12 cash. i showed my mom. she said ‘why did you pay that for 5 years?’ i said ‘idk, i thought insurance was supposed to help.’

now i print the goodrx coupon and hand it to the pharmacist. they always smile. i think they’re tired of seeing people cry too.

Nicola George

January 4, 2026 AT 15:28My cousin works at a pharmacy in Cape Town. They don’t have PBMs there. The price is the price. If it’s $2, you pay $2. If it’s $20, you pay $20. No clawbacks. No MAC lists. No gag clauses. Just a receipt and a pharmacist who says ‘you good?’

So yeah. We’re not the only ones who got this wrong. We just got it *really* wrong.

Babe Addict

January 5, 2026 AT 10:31Everyone’s missing the real issue. PBMs aren’t the problem-they’re the symptom. The real problem is that the FDA lets generics exist at all. If we just made every drug brand-name, the PBM system wouldn’t have a loophole to exploit. You’d have to pay the real price, and then we could actually fix the supply chain. Also, generics are just placebo pills with different packaging. I read it on a forum. It’s true.